THE VALUE OF AN ASSOCIATION – but only if it is acting in your best interest

ASSOCIATIONS OFFER A SIGNIFICANT VALUE IN POLITICAL LOBBYING BY PROVIDING A PLATFORM FOR ORGANISED GROUPS TO REPRESENT DIVERSE INTERESTS, SHARE EXPERTISE AND INFLUENCE POLICY DECISIONS. THEY CAN AMPLIFY THE VOICES OF THEIR MEMBERS, FACILITATE COMMUNICATION WITH GOVERNMENT OFFICIALS AND CONTRIBUTE TO MORE INFORMED AND EFFECTIVE POLICY – MAKING – source: google – The value of Association Lobbying.

It is that time of the year when the Advice Profession participants must make a decision on which Association they will support. The Profession is currently at a pivotal point of its development and needs a strong experienced voice in Canberra to consolidate its position. The key to selecting the best Association option is to match your objectives with the Charter and conduct of the organisation.

AIOFP SUCCESS – why be a member.

The key to successful Association membership is joining an organisation that acts in their Members best interests and delivers what Members need to be successful in their practice, their Profession and their life. The crucial detail of an Association’s conduct and performance is in the ‘small print’ of the Charter and Mission statement, we strongly suggest understanding these objectives before making a decision to join any Association.

The AIOFP Board believes we have delivered better value to Members and the Profession over the past 27 years than any of our competitors.

The key to AIOFP’s success is only having one category of independent Adviser membership complemented by a Board/Management of either past or current independent Advisers, an independent Economics Professor Chair and a Charter to only act in the best interests of our members and no one else. Considering Advisers must act in the best interests of their clients; Consumers directly benefit from this thematic approach and Advisers have security the organisation will protect your position.

In addition, the AIOFP will not sit on the fence politically and its political support cannot be bought, only leased if Member favourable conditions are maintained. More importantly, we will always take a position on an issue and stand for something if it is in the best interests of members. We believe Canberra respects and is wary of our approach, a favourable strategic position to have in the nation’s capital.

The AIOFP has the most successful track record of Legislative, lobbying and educational outcomes for the Advice Profession, they are –

- We developed and successfully lobbied for the Education Pathways Legislation in late 2021.

- We lobbied the Senate cross bench in 2021 to block the CSLR legislation attempt by Minister Hume.

- We assisted with the removal of the Seat of Kooyong incumbent Josh Frydenberg in 2022.

- We recently supported now Small Business Shadow Tim Wilson to defeat the TEALS in the seat of Goldstien.

- We commenced the ongoing education of all Politicians about our Profession from 2015 by regular emails, Conferences in Canberra and meetings.

The AIOFP short, medium and long term objectives are important to understand, they are –

- Short term is to lobby for amendments to LIF, CSLR and the compliance issues, this process commenced 3 years ago and is ongoing.

- Facilitate the highest professional standards that are practical and relevant to Consumers and Advisers.

- Provide new client opportunities for Members, this has commenced with other new projects to be announced at the Gold Coast conference.

- Over the long term, position Advisers and their clients as a powerful political faction that all Politicians are wary of, this will address the political overreach into our Profession.

Over the past 27 years the AIOFP has ‘ruffled plenty of feathers’ whilst endeavoring to act in the best interests of its members, we do not make any apologies for that. Politics ultimately is all about numbers, the larger the Association the more influence it will have BUT only if this Association is acting in your best interests.

The AIOFP is the most successful Advice focussed Association in the Profession by some distance. This document is all about building a compelling case to encourage new members to join and current members to stay.

DECISIONS – WHAT TO LOOK FOR.

When deciding on which Association to support we suggest you consider the following analytical process –

- What is the organisation’s charter, specifically who are they acting in the best interests of…..Consumers, Institutions or Adviser members?

- Ensure you are in the dominant member faction if more than one exists – minority factions have little power.

- What is the principal funding source of the organisation?

- What are the origins and background of the Management and Board?

- What is the track record of achievements?

It is quite obvious the competitive dynamics of the Advice Profession landscape involves three major players – the AIOFP, FSC and the FAAA. Below are the Charter details from the FAAA and FSC websites that should be understood before making a decision to join.

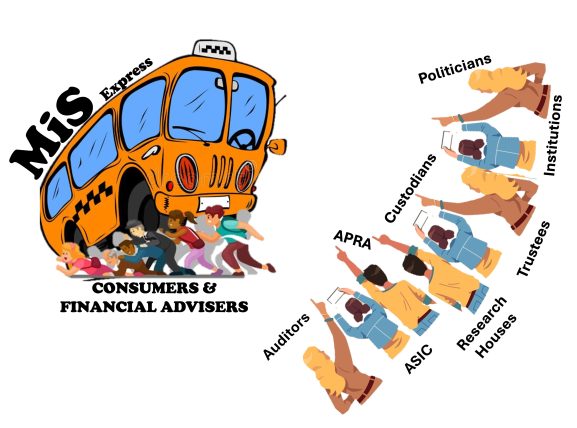

The FAAA specifies acting in the best interests of Consumers and Advisers, recent history demonstrates the FPA’s Charter was similar but unfortunately, they cooperated with the FSC/AFA/Minister O’Dwyer in 2015 to produce LIF/FASEA etc justifying the controversial decision on acting in the best interests of Consumers…..a diabolically poor decision for both Advisers and Consumers.

The FSC nominates ‘financial advice licensees’ in with retail/wholesale funds management, superannuation funds and institutions they represent….. considering they are funded by the Institutions and the board/management are from Institutional backgrounds, why would an Adviser give the FSC their political capital to ultimately use against themselves in Canberra? Their very impressive track record of delivering LIF/FASEA/Grandfathered ban and CSLR are not great outcomes for the Advice Profession, it seems they want to leverage off having Advisers in their membership to engage in Canberra. That is a dangerous outcome for the Advice Profession, we cannot understand why Advice groups want to be their members…..

OTHER CONSIDERATIONS

Canberra has long complained that our Profession has too many Associations with diverging views and they are correct. Since 2015 the Adviser numbers have at least halved due to the ‘culling’ objective of the last Government but we now have 12 Associations trying to represent 50% less Financial Advisers in Canberra. The original JAWG group of FPA, AFA, BFP, CPA, FSC, FINSIA, IPA, Licensee Leadership Forum, SMSF, Stock Brokers, Adviser Association [AMP] has clearly not worked. How can you have Institutions, Product Manufacturers, Accountants, Stock Brokers and Financial Advisers reaching a consensus? It has never happened before and is never likely to.

The JAWG track record of achievement is poor, all it has done is confuse Canberra and allowed the FSC to break from the JAWG pack to adjust CSLR to suit the Institutions and smash the Advice Profession.

The spectacular success of the Mortgage Brokers in 2019 was due to only having 2 collaborating Associations involved and political timing, the AIOFP Board rejected joining the JAWG consortium business model in favour of our above focussed business model approach which has clearly worked.

The Board welcomes all independently owned Advisers to join the AIOFP to amplify and participate in our success.

Peter Johnston | Executive Director