CSLR – THE MODERN DAY GRIM REAPER

INTRODUCTION – The Compensation Scheme of Last Resort’s [CSLR] initial concept and genesis was supported by all industry stakeholders, a pleasing outcome for the Advice Profession and Consumers at the time.

Unfortunately however, the CSLR guidelines were professionally tampered with at the point of legislation in June 2023, an event that has greatly disadvantaged Consumers and the Advice Profession. Although we welcome former Minister Jones’s pre – retirement/election initiative of instructing Treasury to review certain aspects of CSLR, it will only ever be a ‘band aid’ solution. CSLR Legislation is fundamentally and critically flawed, it has become potentially the Grim Reaper of the Advice Profession.

This pause will hopefully give Minister Mulino time to reassess the circumstances/unintended consequences of this event and recommend structural legislative change. Unfortunately the previous Government wasted 3 years with severe vacillation that allowed this legislation pass through Parliament.

THE PROBLEM – The crucial issue is the current CSLR legislation does not reflect the intent of the 2017 Ramsay Review and Commissioner Hayne’s RC 2019 intentions which had considerable market support. We believe the CSLR outcome was heavily and successfully lobbied by the Financial Services Counsel [FSC] to favour of Institutions/Product Manufacturers [manufacturers] at the expense of others. Taking advantage of technical ignorance with Politicians and Bureaucratic bias in Canberra at the time, Manufacturers were excluded from being held to account for the management/performance of their own Financial Products and this responsibility was inexplicably and unfathomably passed onto the Advice Profession and their Consumer clients.

It was truly an astonishing achievement by the FSC for their institutional Members to negotiate this position but unfortunately a diabolical outcome for Consumers and the Advice Profession.

In recent times the AIOFP has written to RC Commissioner Kenneth Hayne, ASIC Commissioner Alan Kirkland, former Professor Ian Ramsay and current Productivity Commissioner Julie Abramson requesting their assistance with Consumers and the Advice Profession to avoid a catastrophic outcome. We are seeking their cooperation to publicly state that the CSLR structure they initially recommended is not reflected in the current CSLR Legislation. Please note that Kirkland/Ramsay/Abramson were the original and only Ramsay Review panelists.

We have been disappointed with the response from three, whereas Mr Kirkland is the only one not to respond. The responses varied from ‘not wanting to be involved’, ‘no longer interested’ and too conflicted to comment’. Considering the many millions spent by Consumers/tax payers on these matters and the influence these individuals have wielded, they should be compelled to comment post release when its in the best interests of Consumers in our view. We contend that if any of these highly esteemed and respected individuals cooperated, it will shine a different light on the CSLR issue.

We will now be writing to the Chair of the FSC seeking their cooperation with informing Minister Mulino that their lobbying success with the CSLR Legislation needs to be rescinded due to the seriousness of the unintended consequences.

Considering CSLR and the Life Insurance Framework Legislation [LIF] are arguably the two most draconian legislative outcomes in Financial Services history, and the FSC successfully lobbied both outcomes, we will be requesting they also include the modification of LIF in their report to the Minister.

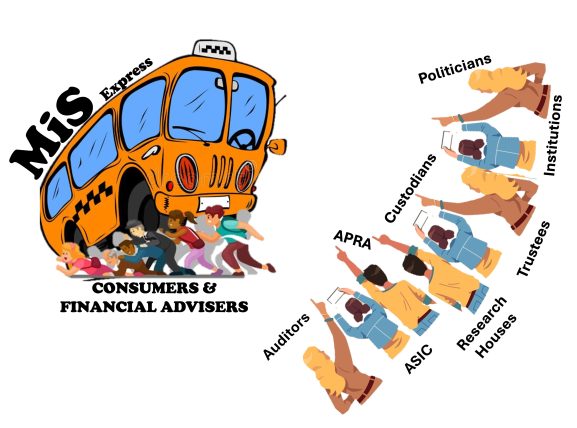

REGULATION FAILURE – The truism ‘history always repeats itself’ applies to the latest SHIELD Superannuation failure. In 2009 the TRIO/ASTARRA circa $180 million Superannuation fraud exposed numerous massive flaws in the regulation of the funds management industry including the role of custodians, research houses, trustees, auditors and ASIC/APRA. The subsequent Senate Enquiry exposed the numerous blatant flaws with the conduct of these stakeholders but very little has been done about modifying their behaviour over the last 14 years by ASIC and APRA. Being a Superannuation fraud, APRA was held responsible and victims were compensated, ASIC were heavily criticized for their conduct.

It should be noted that the role of Financial Advisers in this Senate Report was negligible, it was clearly a regulatory failure by ASIC and APRA who at the time typically ‘spun’ the blame onto the hapless Financial Advisers. We are very pleased that market sentiment is now moving away from blaming Financial Advisers for product failure and focussing on the failure of Regulation, the incompetencies in the Funds Management sector and those who should be monitoring them. Furthermore, the ASIC press release on 2/6/25 detailing widespread compliance deficiencies in the Managed Funds Management industry comes as no surprise, this has been happening since the flawed MIS legislation was introduced over 33 years ago.

It is time for Canberra Bureaucrats and senior Politicians to move away from blaming/bullying innocent parties, admit there is a major failure of Regulation with ASIC and finally do something about it. We would also like to point out that NOT having experienced Financial Advisers on any policy decision making panel is a big mistake for very obvious reasons, Practitioner feedback on the relevance and practicality of policy content is essential to mitigating red tape and lowering the cost of advice for Consumers.

SUMMARY – The manipulated CSLR legislation is an attempt to perpetuate the flawed and outdated narrative that Financial Advisers are responsible for the failure of financial products. This no doubt suits the agenda of ASIC and the other stakeholders, but it must end.

ASIC have been avoiding responsibility for decades by ‘spinning’ the blame onto the Advice Profession to protect their own market image but in doing so they have allowed the other stakeholders to be less than efficient with their conduct, particularly the ‘big end of town’. The abovementioned ASIC press release on 2/6/25 says it all, it was a bold attempt to again deflect blame onto others but in the process highlighted their own ongoing deficiencies.

ASIC takes no responsibility for allowing flawed products onto the market and no responsibility for the ongoing monitoring of these products, so what does ASIC actually do to protect Consumers from Products failing? Judging from its numerous press releases it spends the vast majority of its time being REACTIVE to relatively minor market offences by attacking low hanging ‘Adviser fruit’ and NOT being PROACTIVE by holding other stakeholders to account for their conduct including themselves.

The CSLR manipulation has severely clouded the future viability of the Advice Profession, Financial Advisers have no choice but to pass the ASIC and CSLR levies back to clients which is clearly not sustainable. Furthermore, it is extremely difficult to attract new entrants into the Advice Profession with the grossly unfair CSLR liabilities casting a massive black cloud over the industry.

The CSLR solution is quite straight forward, Manufacturers pay for product failure, Financial Advisers for poor advice outcomes and Risk Advisers for poor risk advice failure. Banning Financial Advisers from creating a vertically integrated business model will eliminate future ambiguity around the responsibility if a product fails.

Peter Johnson | Executive Director