AIOFP & FBAA JOIN POLITICAL FORCES

JAWG BRANDED TOOTHLESS

A WINDOW OF OPPORTUNITY OPENS FOR ADVISERS.

The traditional role of ‘fence sitting’ Associations has changed, members are now demanding meaningful action to protect their interests.

The next 12 months is a potentially momentous occasion for the Adviser community to capitalise upon. Politicians are always vulnerable leading into the re-election period where they must listen or risk losing their seat and livelihood. It is no mere coincidence that the only 2 Adviser friendly legislative outcomes of the 21st century occurred leading into the 2019 and 2022 Federal elections.

In 2019 the Finance/Mortgage Industry [via FBAA] took on both sides of politics leading into the Election over brokerage issues and had a stupendous victory. In 2021 the AIOFP devised and lobbied for the Education Pathway/10-year rule, achieved bipartisan support leading into the 2022 Election and it was passed in September 2023. A great and sensible outcome for the Adviser community.

History has a habit of repeating itself and the next 12 months is a critical window of opportunity for the Adviser community to achieve the much-needed Compliance, ASIC Levy and Risk Insurance amended outcomes. This is the time Politicians will listen, self-interest will always prevail, but we need to be strong, united and strategic. This is a once in a three-year opportunity, we must take advantage of it.

Unfortunately, however, we have a certain group over the last 12 months ‘muddying the political waters’ in Canberra for the Adviser community that needs to be dealt with.

We were critical of the Joint Association Working Group’s [JAWG] formation from the outset for the following reasons –

• 12 Associations/groups of different origins and agenda’s [Institutional, Accounting, Advice] in one room trying to reach a consensus will always be problematic.

• The 2015 alignment of the FSC/FPA/AFA with Minister O’Dywer and the resultant LIF/FASEA/Grandfathering legislation strongly suggests positive Institutional and independent Adviser outcomes rarely eventuate.

• Canberra has been critical of the Advice industry for not being united on major issues, this structure and behaviour is exactly what Canberra does not want.

• The foundation JAWG ‘theme’ document clearly stated – ‘CONSUMER FOCUSSED – putting Consumer, Customer and Client needs first.’ as their primary objective. Yes, we agree Consumers come first BUT what about Advisers and their 12 – year nightmare journey?

The Adviser community cannot afford to have JAWG representing their interests in Canberra, they are considered politically toothless. Well informed sources confirm JAWG is currently an indecisive talkfest of disparate Associations who cannot reach a consensus. The legislative scoreboard has no mention of any JAWG outcomes, we simply don’t need or want the Accounting fraternity and/or the Banks/Institutional lobby meddling in Adviser affairs. It is time they stayed with their core issues and await our call for assistance if required.

In addition, JAWG looks like it has morphed into the duplicitous Institutional ‘divide and rule’ strategy inflicted on Advisers over the last 30 years where disagreeing/indecisive Advisers were bypassed as others dealt directly with Canberra offering solutions. The LIF/FASEA outcome is a prime example of this strategy and the FSC has proven to be an expert in this devious behaviour over the last 12 years. Why would any Adviser want the FSC acting on their behalf?

We must put an end to this conduct by distancing ourselves from the Institutional/Accounting agendas.

We also contend that Advisers no longer want their Association being indecisive and ‘sitting on the fence’ fearing upsetting either side of politics. Advisers want their Association to stand for something, take a firm position and be prepared to strongly defend when required to protect their interests. Members today are demanding relevancy and value for money in return for their subscription, not indecision and/or ambivalence.

We are pleased to inform you that the AIOFP and Finance Brokers Association Australia [FBAA] CEO Peter White AM have agreed to work collaboratively to establish a panel of Adviser focussed Associations to represent all members in Canberra. This panel will be known as the INDEPENDENT FINANCIAL COUNSEL [IFC] and we will invite other like – minded Associations to join over the next few months.

All Politicians will now be encouraged to seek information and direction from the IFC about Adviser/consumer related issues in both the financial advice and Mortgage/lending disciplines. When you consider the mortgage/loan industry have around 18,000 members plus clients, they are also a considerable political force.

Besides for our joint political advocacy success for members, we both see commercial and networking opportunities for our joint membership to benefit from.

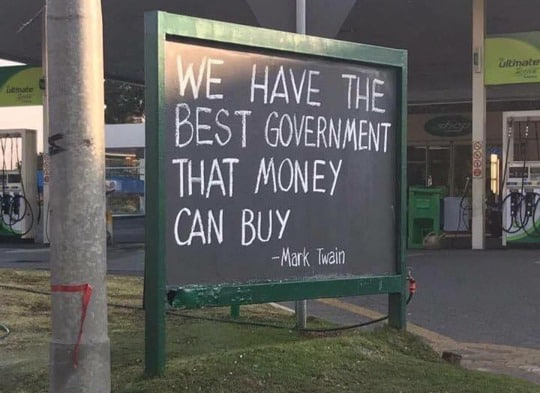

In closing we wish to remind you of the classic adage that sums up the current challenge facing Advisers –

‘ IF YOU ALWAYS DO WHAT YOU ALWAYS DID, YOU WILL ALWAYS GET WHAT YOU HAVE ALWAYS GOT’

Advisers need to be represented by Adviser focussed Associations in Canberra without the Institutional or Accounting lobby involved. The AIOFP and the FBAA are the only two Adviser focussed Associations this century that have delivered positive legislative outcomes for Advisers and consumers. We have successfully challenged the traditionally flawed political convention of Associations ‘fence sitting’ by vigorously defending our members without fear or favour and with no need to have ‘alien’ Associations involved.

We invite you to join, support the cause and protect your own future if you are not already involved. Please send this information onto any non – members for consideration.

Peter Johnston | Executive Director